Our platform helps you streamline your business processes with features including:

Let Quandis Data Solutions do the search and monitoring for you, helping you stay in compliance with SCRA, MLA, and Bankruptcy requirements.

Connect your existing systems effortlessly with Quandis to

enhance efficiency and unify your operations.

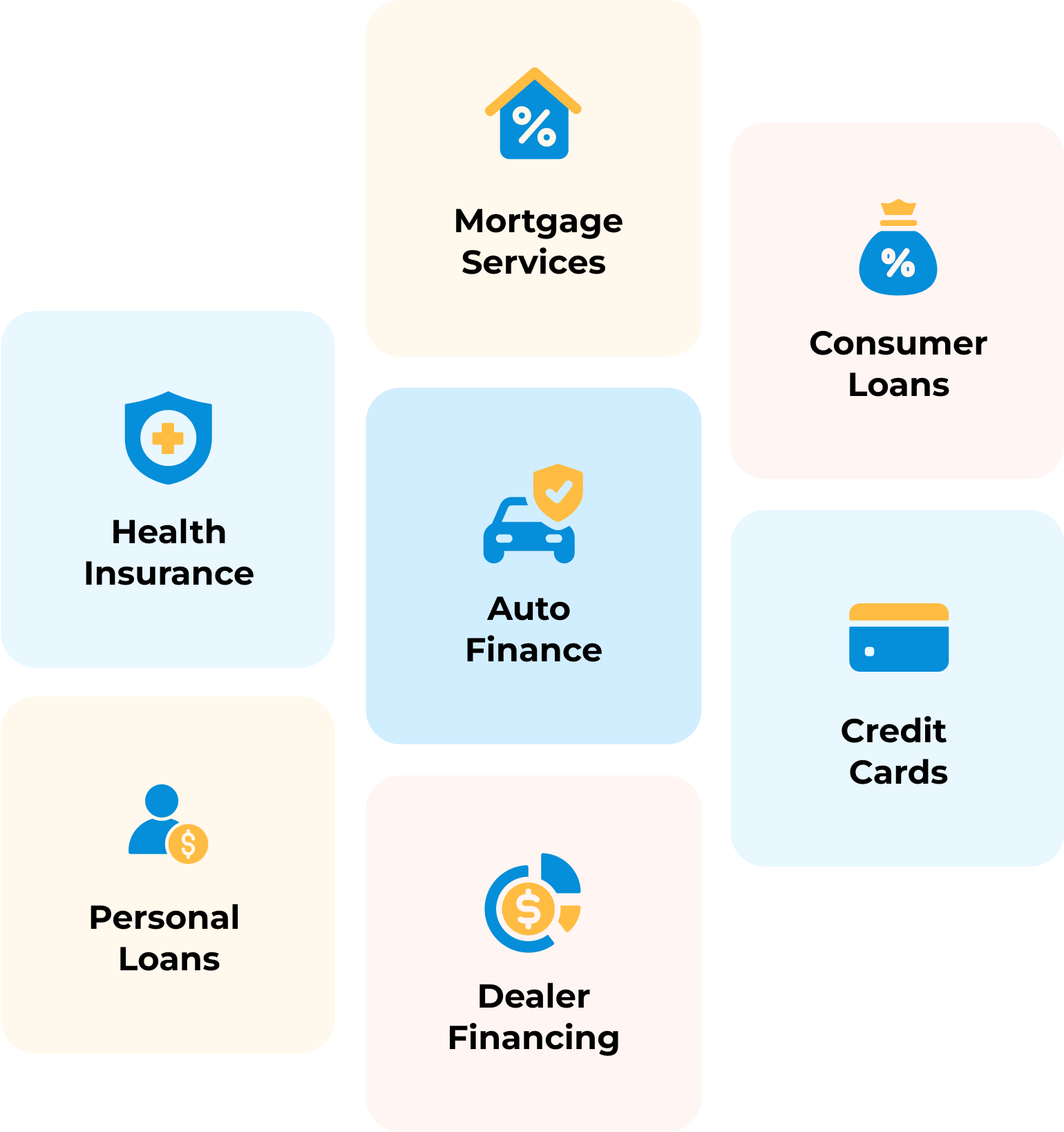

Discover how Quandis delivers specialized solutions to meet

the unique needs of your industry

We’re here to help you solve your unique business challenges. Reach out to us, and let’s discuss how Quandis can make a meaningful impact on your operations and success.